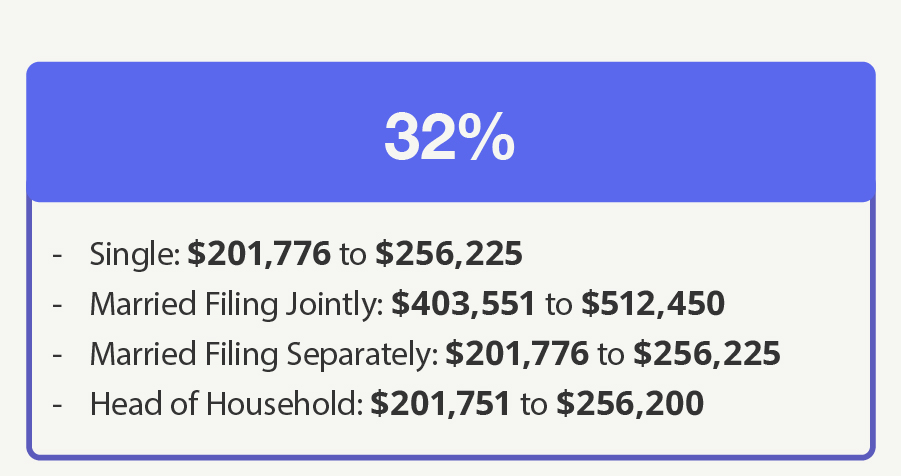

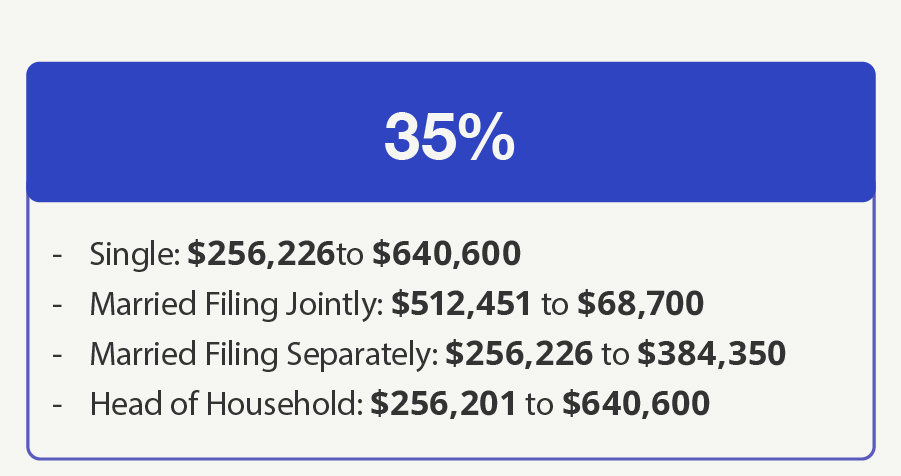

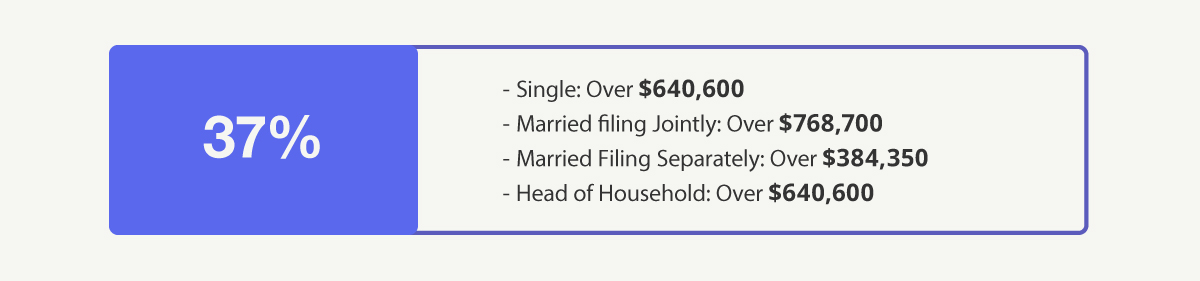

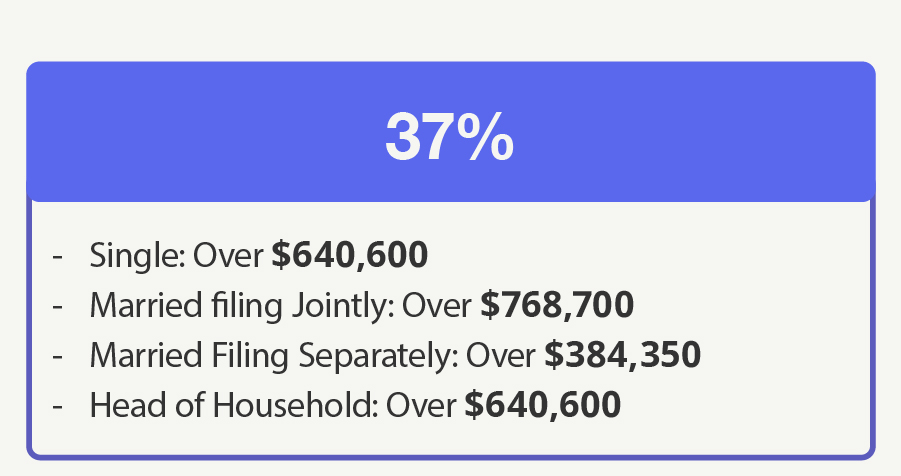

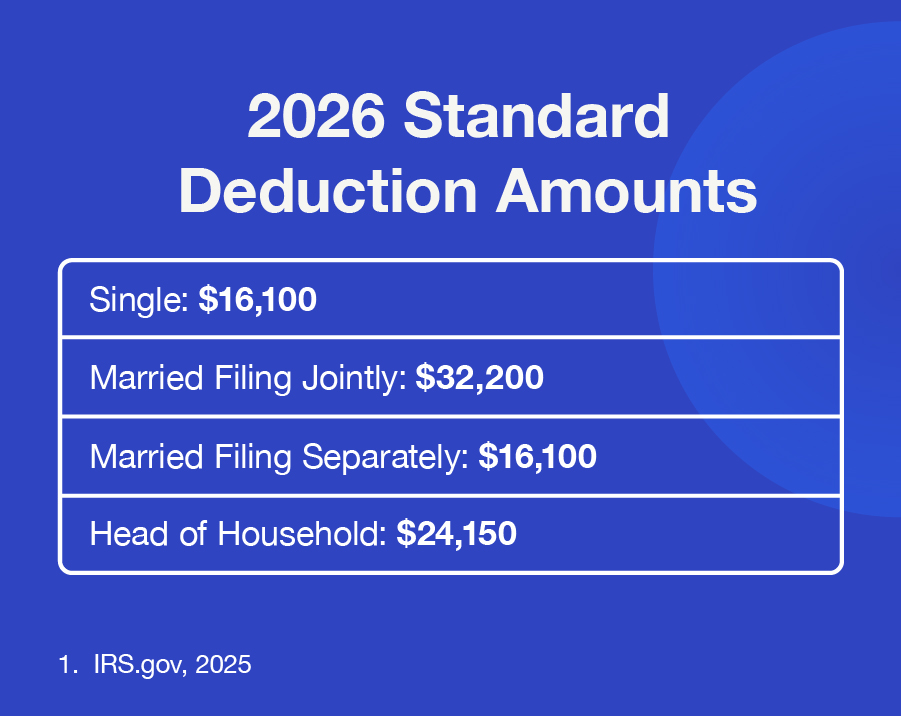

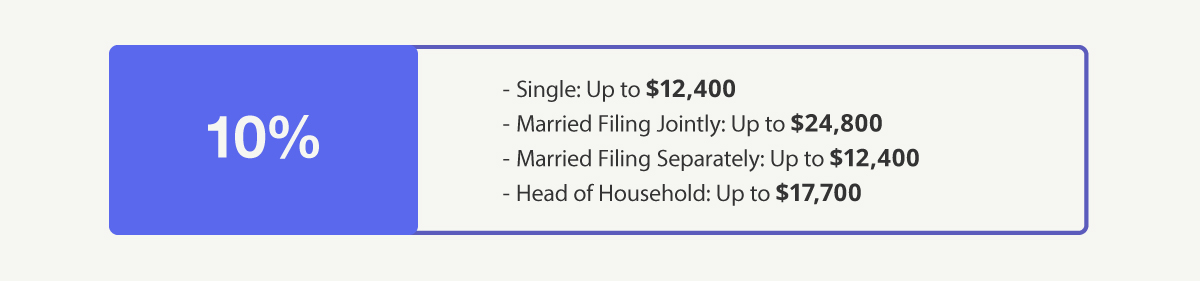

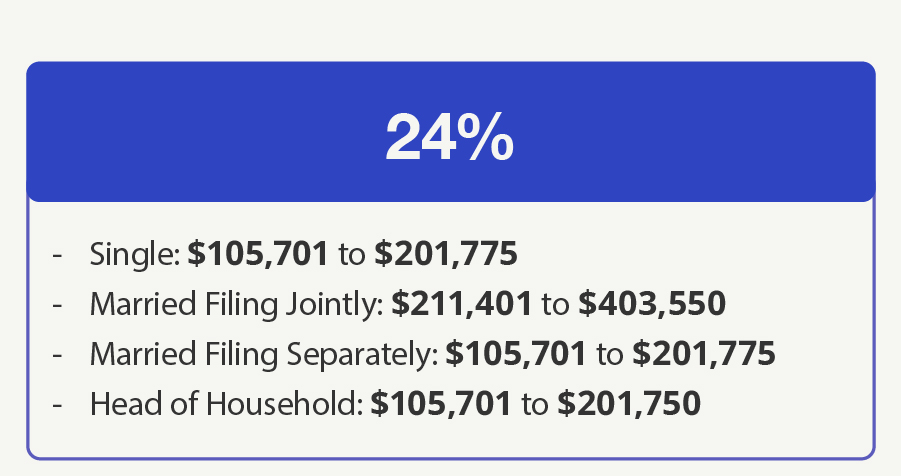

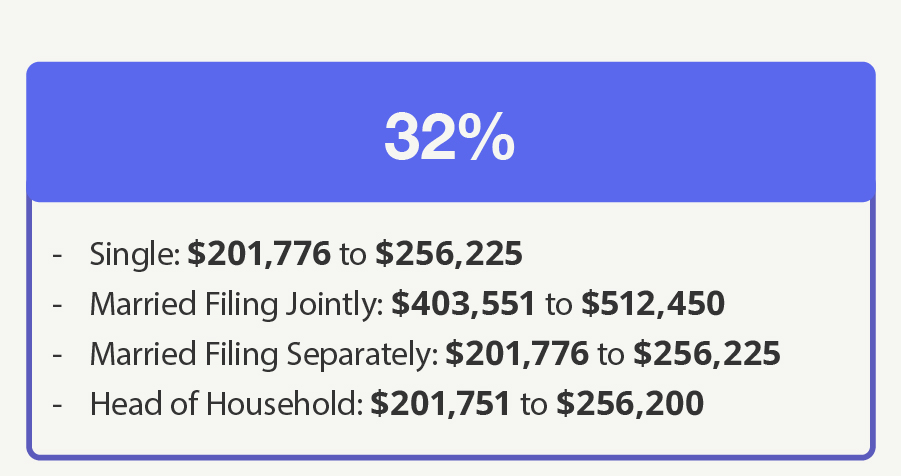

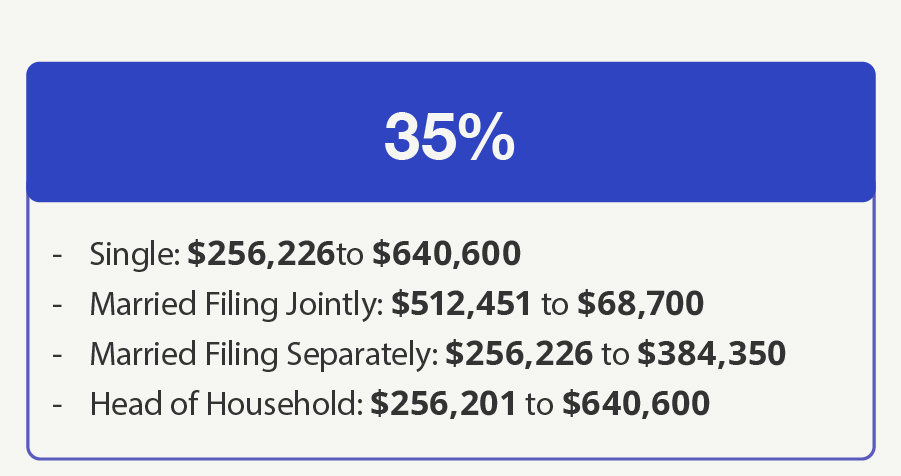

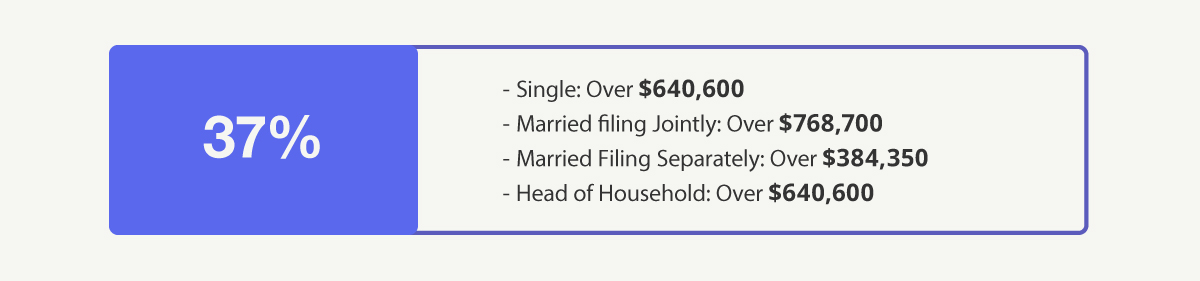

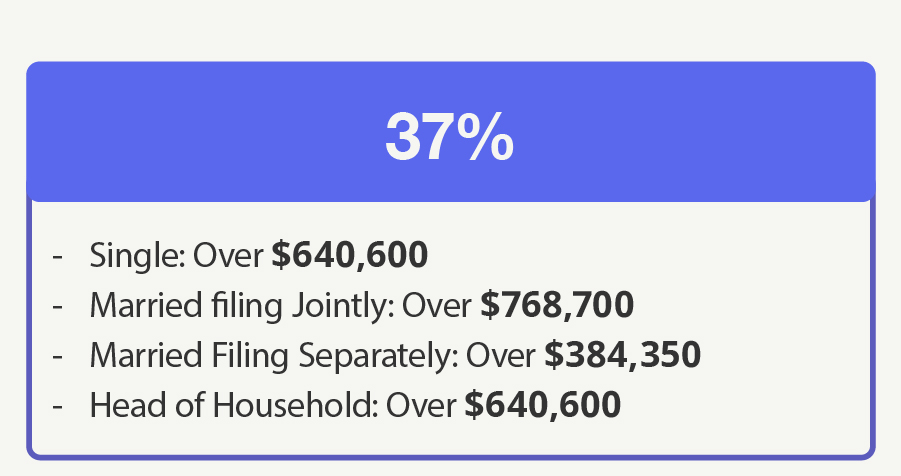

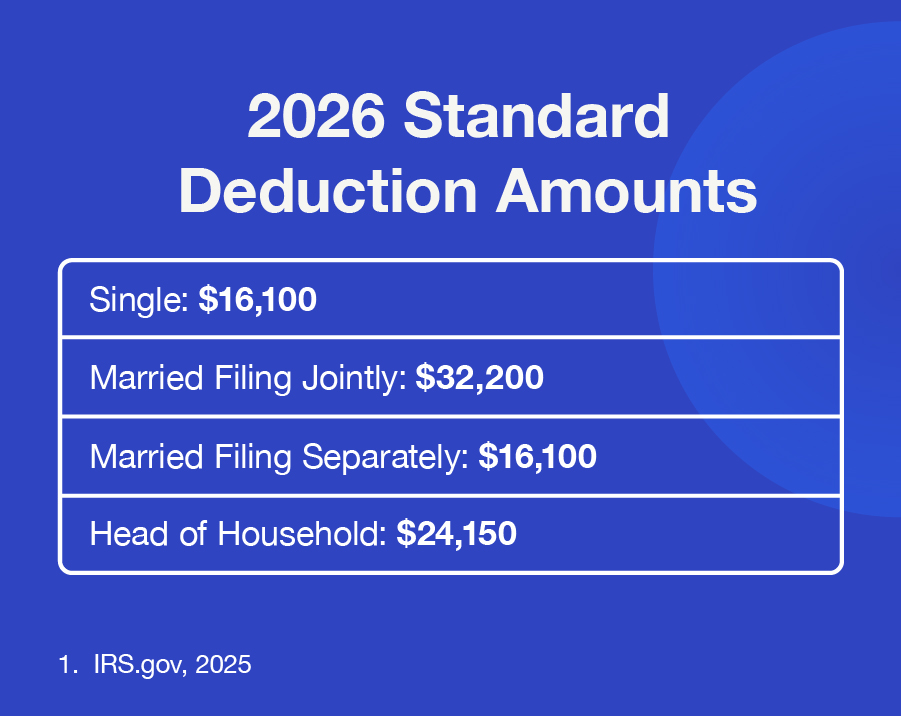

What's My 2026 Tax Bracket?

Some people may want a more advanced gifting strategy that can maximize their gift and generate potential tax benefits.

Alternative investments are going mainstream for accredited investors. It’s critical to sort through the complexity.

While some subscriptions can enhance your daily routines, they can also sneakily erode your retirement savings.